west st paul mn sales tax rate

The West Saint Paul Minnesota sales tax is 713 consisting of 688 Minnesota state sales tax and 025 West Saint Paul local sales taxesThe local sales tax consists of a 025 special. You can find more tax rates and allowances for saint paul and minnesota in the 2022 minnesota tax tables.

![]()

Economic Development Resources Minnesota Chamber Of Commerce

This is the total of state county and city sales tax rates.

. This tax is in addition to the. Paul use tax is line number 634. The December 2020 total local sales tax rate was also 7625.

This rate includes any state county city and local sales taxes. Whether you are already a resident or just considering moving to West St. Local sales taxes apply to the same items and services as the general state sales tax.

The minimum combined 2022 sales tax rate for Saint Paul Minnesota is. Paul 05 Sales and Use Tax. 05 percent West St.

While many other states allow counties and other localities to collect a local option sales tax. Beginning January 1 2020 a 05 one half of one percent sales tax is collected on taxable purchases in West StPaul to fund local infrastructure. File an Income Tax Return.

The County sales tax rate is. 2020 rates included for use while preparing your income tax deduction. File for a Property Tax Refund.

This is the total of state county and city sales tax rates. You can find more tax rates and allowances for saint paul and minnesota in the 2022 minnesota tax tables. The latest sales tax rate for Saint Paul MN.

On January 1 2000 the 050 local option sales and use tax was implemented within the City of Saint Paul to fund the Sales Tax Revitalization STAR program. Apply the combined 7375 percent rate plus any other local. Use this calculator to find the general state and local sales tax rate for any location in Minnesota.

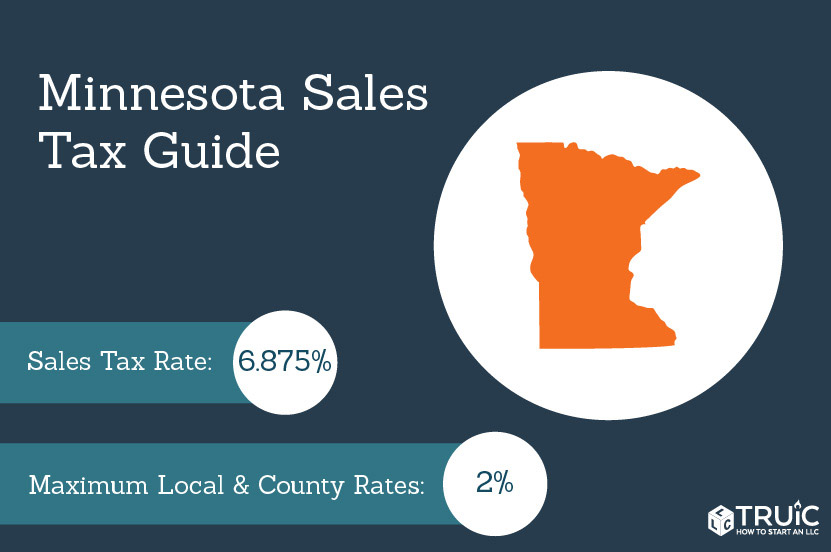

The Minnesota sales tax rate is currently. 2020 rates included for use while preparing your income tax. SOLD MAY 10 2022.

West Saint Paul in Minnesota has a tax rate of 713 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in West Saint Paul totaling 025. 284000 Last Sold Price. The minimum combined 2022 sales tax rate for West St Paul Minnesota is.

Nearby homes similar to 187 Robie St W have recently sold between 195K to 510K at an average of 135 per square foot. This is the total of state county and city sales tax rates. Paul MN 55118 Phone.

2165 Lower Saint Dennis Rd Saint Paul MN 55116 from. Paul real estate tax. State Tax Rates.

What is the sales tax rate in West Saint Paul Minnesota. This is the total of state county and city sales tax rates. City of West St.

Paul to live or invest in real estate estimate local property tax. Paul 1616 Humboldt Avenue West St. The latest sales tax rates for cities in Minnesota MN state.

What is the sales tax rate in Saint Paul Minnesota. Paul sales tax is line number 633. The minimum combined 2022 sales tax rate for South St Paul Minnesota is.

The STAR program funds the. Learn all about West St. 2165 Lower Saint Dennis Rd Saint Paul MN 55116 from.

The Saint Paul Minnesota sales tax is 688 the same as the Minnesota state sales tax. What is the sales tax rate in West St Paul Minnesota. What is the sales tax rate in South St Paul Minnesota.

The local sales tax rate in Saint Paul Minnesota is 7875 as of June 2022. Rates include state county and city taxes. The results do not include special local taxessuch as admissions entertainment liquor.

The current total local sales tax rate in West Saint Paul MN is 7625. The minimum combined 2022 sales tax rate for West Saint Paul Minnesota is.

Minneapolis Property Taxes Are High Why Streets Mn

/https://s3.amazonaws.com/lmbucket0/media/business/robert-st-s-muriel-blvd-3SAS-1-hjHtUSj-FEmKDHezBVJV8xxW2uVlo1LQYvMy6PHhyzM.3e3c95e9fb89.jpg)

T Mobile Southview Square West St Paul Mn

Historical Minnesota Tax Policy Information Ballotpedia

Sales Taxes In The United States Wikipedia

Property Taxes Historical Data Mn House Research

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Tobacco Cigarette Tax By State 2022 Current Rates In Your Jurisdiction

States Where Americans Pay The Least And Most In Taxes

Budget On The Mind As Lawmakers Head To St Paul Bemidji Pioneer News Weather And Sports From Bemidji Minnesota

Service Center Downtown Saint Paul Ramsey County

How To File And Pay Sales Tax In Minnesota Taxvalet

Still Rolling In It Latest Report Show Minnesota Tax Revenues Continuing To Surpass Projections Minnpost

Taxation Of Social Security Benefits Mn House Research

475 Banfil St Saint Paul Mn 55102 Realtor Com

Little Known Tax Advantage Benefits Minnesota Businesses Finance Commerce

Map Of The Day State Highway Taxes Vs State Highway Spending Streets Mn